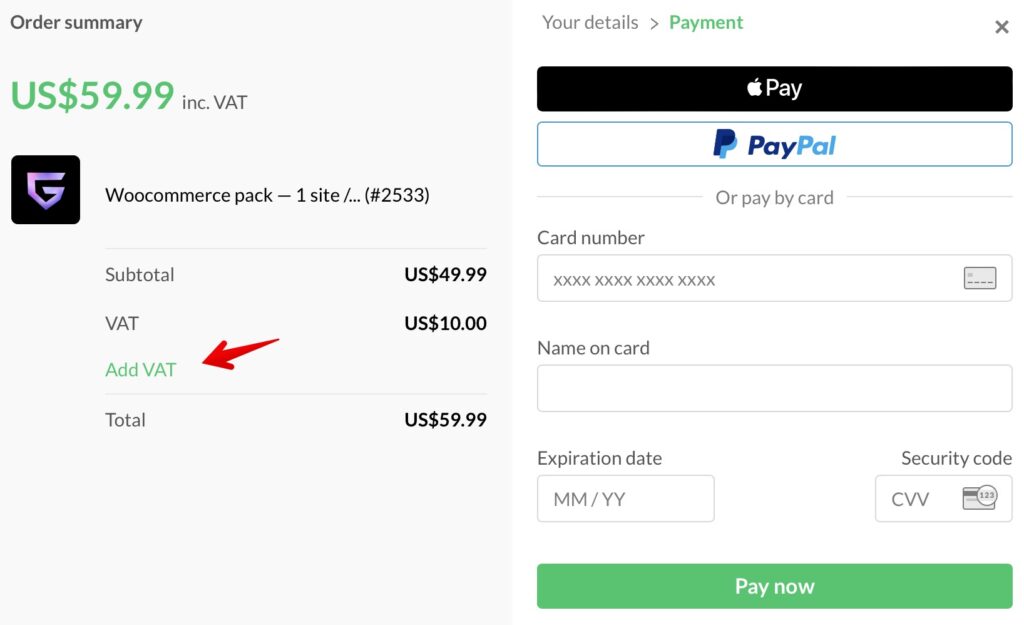

When you select the plan which you want to buy, in the last step you need to set your country. Depending on your choice, additional taxes can be added. We don’t take this extra payment, it’s added automatically by the processing company and regulated by the law of each country separately.

If you have registered VAT, then, you will get an auto refund for VAT. You need to provide your VAT number before payment in the relevant field.

Please, note, that VAT refund is available only for B2B payments (business to business), you must have a registered company for this. VAT refund will be provided automatically (usually, it takes 1 minute) after full-price payment on the same card/paypal that you used for payment.

If you are in VAT free country, then you need to make sure to select the proper country where additional taxes are not applied, for example, Albania.

You can also pay directly to PayPal, for this, you need to contact us and ask for a direct PayPal address